Below is new information about HARP, the Home Affordability Refinance Program.

Program Overview

The Federal Housing Finance Agency (FHFA) and the Department of the Treasury introduced HARP in early 2009 as part of the Obama Administration’s Making Home Affordable program. HARP provides borrowers, who may not otherwise qualify for refinancing because of declining home values or reduced access to mortgage insurance, the ability to refinance their mortgages into a lower interest rate and/or more stable mortgage product.Homeowners Helped Since Program Inception

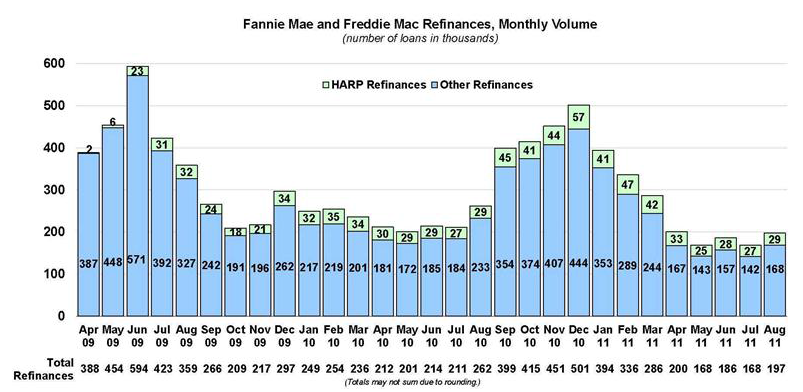

As of August 31, 2011, nearly 894,000 borrowers had refinanced through HARP.HARP is only one refinancing option

HARP is only one of several refinancing options available to homeowners. Since April 2009 when HARP began, Fannie Mae and Freddie Mac have helped approximately nine million families refinance into a lower cost or more sustainable mortgage product. HARP is unique in that it is the only refinance program that enables borrowers who owe more than their home is worth to take advantage of low interest rates and other refinancing benefits.

Borrower Eligibility

- The existing mortgage must have been sold to Fannie Mae or Freddie Mac on or before May 31, 2009.

Homeowners can determine if they have a Fannie Mae or Freddie Mac loan by going to:

http://www.FannieMae.com/loanlookup/ or calling 800-7FANNIE (8 am to 8 pm ET)

https://ww3.FreddieMac.com/corporate/ or 800-FREDDIE (8 am to 8 pm ET) - The program will continue to be available for loans with LTVs above 80 percent.

- Borrowers must be current on their mortgage payments with no late payment in the past six months and no more than one late payment in the past 12 months.

- Borrowers should contact their existing lender or any other mortgage lender offering HARP refinances.

Other Resources

www.MakingHomeAffordable.gov or call 1-888-995-HOPE (4673)www.KnowYourOptions.com or www.FannieMae.com/homeowners

www.FreddieMac.com/avoidforeclosure