Supplemental Directive 15-06 issued July 1, 2015 announced that The

Home Affordable Modification Program (HAMP) will now include a

"streamlined" modification. This new directive does not apply to GSE

mortgages such as those owned or insured by Fannie Mae or Freddie Mac or

VA loans or FHA loans. Those loans are governed by different

directives. Any investor or servicing agreement that permits a servicer

to offer HAMP Tier I or Hamp Tier II is encouraged to permit Streamline

HAMP modifications.

This is another tool to help

homeowners avoid foreclosure. Customers who have previously been

granted a HAMP Tier 1 or HAMP Tier II modification and have experienced a

interest rate step-up and then again become delinquent may be eligible

for the new Streamlined HAMP. This is a relaxation of a previous

prohibition against multiple modification.

Also, if a borrower was previously evaluated for, but not offered, a

HAMP modification, they may be eligible for a Streamline HAMP.

There

are a lot of variables at play in determining if one should be eligible

for a modification or other program to avoid foreclosure. If one

should be eligible, then whether one actually gets the work out is a

function of correctly and completely completing the paperwork. I work

for a HUD-approved housing counseling agency and have over twenty years

experience as a housing counselor. There is no charge for my service. I

can evaluate you for a solution to your housing problem, and if you

should be eligible for a workout, I will help you complete the Request

for Mortgage Assistance. To learn more, or to schedule an appointment

call me.

Rod Williams

615-850-3453

Wednesday, July 1, 2015

Monday, June 15, 2015

Home Affordability Modification Program (HAMP) ends this year. Don't miss out.

From Freddie Mac:

If you need help, don't wait!

My name is Rod Williams and I am a HUD approved housing counselor. There is no cost for my services. Many people who apply for a modification don't get it because they fail to complete a package correctly. I can increase your chance of getting a modification. Also, sometimes a modification is not the best option. If you have a housing problem, don't try to solve it by yourself. Call me at 615-850-3453.

Extensions for HAMP and the Freddie Mac Streamlined Modification Among the Highlights in Guide Bulletin 2015-9

We are making several updates reflected in Freddie Mac Guide Bulletin 2015-9, including the following key highlights:

- A one-year extension of the Home Affordable Modification Program (HAMP). As a result of previous announcements made by the U.S. Department of the Treasury and the Federal Housing Finance Agency to extend HAMP, we have updated Section C65.4 of the Guide to require that all HAMP modifications have a Modification Effective Date on or before September 1, 2017, and that all evaluations for HAMP must be based on a complete Borrower Response Package submitted on or before December 31, 2016.

If you need help, don't wait!

My name is Rod Williams and I am a HUD approved housing counselor. There is no cost for my services. Many people who apply for a modification don't get it because they fail to complete a package correctly. I can increase your chance of getting a modification. Also, sometimes a modification is not the best option. If you have a housing problem, don't try to solve it by yourself. Call me at 615-850-3453.

Tuesday, May 26, 2015

HARP extended through 2016

The program known as Keep My

Tennessee Home, which was Tennessee's version of the Hardest Hit Fund

program ended some months ago, but there are still options available for

avoiding foreclosure if you are having difficulty making your house

payments. For a review and evaluation call me. I am a housing

counselor with a HUD-approved housing counseling agency and there is no

cost for my services. Rod Williams, 615-850-3453.

Below is new information about HARP, the Home Affordability Refinance Program.

www.KnowYourOptions.com or www.FannieMae.com/homeowners

www.FreddieMac.com/avoidforeclosure

Below is new information about HARP, the Home Affordability Refinance Program.

Program Overview

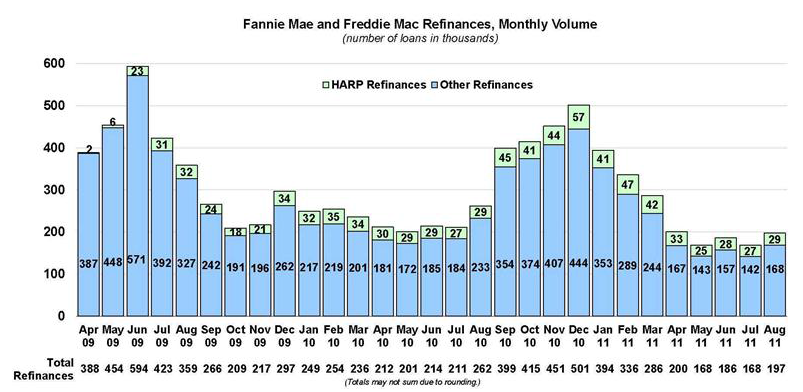

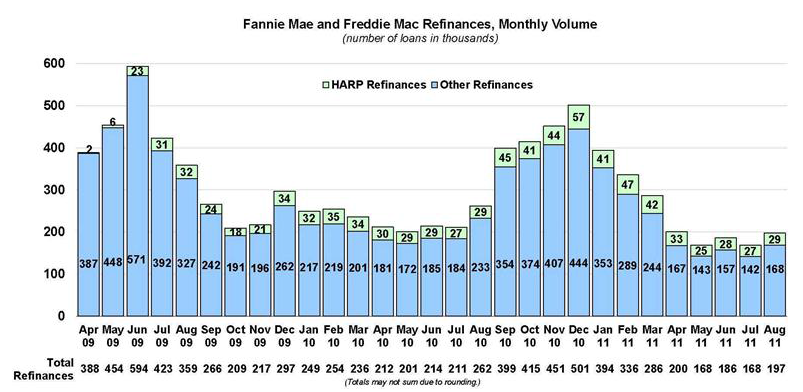

The Federal Housing Finance Agency (FHFA) and the Department of the Treasury introduced HARP in early 2009 as part of the Obama Administration’s Making Home Affordable program. HARP provides borrowers, who may not otherwise qualify for refinancing because of declining home values or reduced access to mortgage insurance, the ability to refinance their mortgages into a lower interest rate and/or more stable mortgage product.Homeowners Helped Since Program Inception

As of August 31, 2011, nearly 894,000 borrowers had refinanced through HARP.HARP is only one refinancing option

HARP is only one of several refinancing options available to homeowners. Since April 2009 when HARP began, Fannie Mae and Freddie Mac have helped approximately nine million families refinance into a lower cost or more sustainable mortgage product. HARP is unique in that it is the only refinance program that enables borrowers who owe more than their home is worth to take advantage of low interest rates and other refinancing benefits.

Borrower Eligibility

- The existing mortgage must have been sold to Fannie Mae or Freddie Mac on or before May 31, 2009.

Homeowners can determine if they have a Fannie Mae or Freddie Mac loan by going to:

http://www.FannieMae.com/loanlookup/ or calling 800-7FANNIE (8 am to 8 pm ET)

https://ww3.FreddieMac.com/corporate/ or 800-FREDDIE (8 am to 8 pm ET) - The program will continue to be available for loans with LTVs above 80 percent.

- Borrowers must be current on their mortgage payments with no late payment in the past six months and no more than one late payment in the past 12 months.

- Borrowers should contact their existing lender or any other mortgage lender offering HARP refinances.

Other Resources

www.MakingHomeAffordable.gov or call 1-888-995-HOPE (4673)www.KnowYourOptions.com or www.FannieMae.com/homeowners

www.FreddieMac.com/avoidforeclosure

Wednesday, July 2, 2014

Keep My Tn Home ends July 21st!

The Keep My Tennessee Home program is running out of money and winding down. It will not be renewed. When it is gone, it is gone. If you have been putting off applying, don't delay any longer!

If interested in the program, call me. I will screen you on the phone and not waste your time.

Rod Williams 615-850-3453

This is for middle Tennessee homeowners only.

If interested in the program, call me. I will screen you on the phone and not waste your time.

Rod Williams 615-850-3453

This is for middle Tennessee homeowners only.

Friday, May 30, 2014

Last chance for Keep My Tn Home program

The Keep My TN Home program which can provide up to $40,000 in free money to help those who have experience a housing hardship, is coming to an end very, very soon. If you think you may qualify, call me. I will evaluate you over the phone. I can speed up the process. Your best chance of getting this program before it ends is by contacting me: Rod Williams 615-850-3453. Middle Tennessee residents only.

Friday, January 10, 2014

I was the Counselor who helped Ms Phyllis Qualls-Brooks save her home. Call me and let me see if I can help you.

I was the Counselor who helped Ms Phyllis Qualls-Brooks save her home. Call me and let me see if I can help you. Rod Williams 615-850-3453

Thursday, November 14, 2013

Keep My Tn Home winding down. Don't delay. Apply now.

To take advantage of this program, do not delay. I don't know for

sure when the program will end but it will be soon. We have first heard

from THDA that the program could end as early as January but then more

recently we heard it may last until March or April. If you think you may

be eligible for this program, don't delay. When it ends, I do not know

if we will be told to not take new applications but to continue to work

those who are in the pipeline, or if we will be told to stop submitting

files.

From the time I have a complete file, it still takes about six weeks to get an application approved. Often it takes a client up to a month, sometimes longer, to get their documents to me.

If you make contact directly with me, I will shorten the process for you. Tell me you are being referred from this website and you will get to skip the class that clients normally have to go to before they see a counselor. Also, not to be immodest but I am one of the most experienced and successful counselors working this program. I have over twenty years experience as a housing counselor and know the KMTH program and other work-out options inside and out. I am one of the best and, I won't waste your time. If you are not eligible, I will tell you. Also, feel free to call for a phone screening. There is no cost for our services. There is no cost for getting the Keep My TN Home assistance.

If you qualify, what Keep My TN Home can do for you is bring your loan current and make your house payment for up to three years or until $40,000 is spend on your behalf. I know that sounds unbelievable and too good to be true, but it is. I am not offering an opinion of whether or not I think it is a good policy or a wise policy. I don't make policy or comment on policy on this blog, I am just trying to drum up some business. Why would I do that? I don't make any money off of serving you, but I do want to be a productive employee and maintain a record as a high producer. Who knows? When this program ends, there may be less demand for housing counselors and I want to remain one of the best in the business. So, call me and let me help you save your home. Rod Williams 615-850-3453.

To be eligible, you must of lost your job or had a decrease in income or suffered another eligibility hardship through no fault of your own. There are some other restrictions but most people meet the other requirements. Don't assume you are not eligible. Don't immediately register on the Keep My Tn website, call me first.

If you are closer to Memphis or Knoxville or Chattanooga than Nashville you need to be served somewhere else; go to this website: http://www.keepmytnhome.org. This program is only for Tennessee residents but about 19 other states have their own version of the same program. Nationally the program is know as the Hardest Hit program.

From the time I have a complete file, it still takes about six weeks to get an application approved. Often it takes a client up to a month, sometimes longer, to get their documents to me.

If you make contact directly with me, I will shorten the process for you. Tell me you are being referred from this website and you will get to skip the class that clients normally have to go to before they see a counselor. Also, not to be immodest but I am one of the most experienced and successful counselors working this program. I have over twenty years experience as a housing counselor and know the KMTH program and other work-out options inside and out. I am one of the best and, I won't waste your time. If you are not eligible, I will tell you. Also, feel free to call for a phone screening. There is no cost for our services. There is no cost for getting the Keep My TN Home assistance.

If you qualify, what Keep My TN Home can do for you is bring your loan current and make your house payment for up to three years or until $40,000 is spend on your behalf. I know that sounds unbelievable and too good to be true, but it is. I am not offering an opinion of whether or not I think it is a good policy or a wise policy. I don't make policy or comment on policy on this blog, I am just trying to drum up some business. Why would I do that? I don't make any money off of serving you, but I do want to be a productive employee and maintain a record as a high producer. Who knows? When this program ends, there may be less demand for housing counselors and I want to remain one of the best in the business. So, call me and let me help you save your home. Rod Williams 615-850-3453.

To be eligible, you must of lost your job or had a decrease in income or suffered another eligibility hardship through no fault of your own. There are some other restrictions but most people meet the other requirements. Don't assume you are not eligible. Don't immediately register on the Keep My Tn website, call me first.

If you are closer to Memphis or Knoxville or Chattanooga than Nashville you need to be served somewhere else; go to this website: http://www.keepmytnhome.org. This program is only for Tennessee residents but about 19 other states have their own version of the same program. Nationally the program is know as the Hardest Hit program.

Subscribe to:

Posts (Atom)